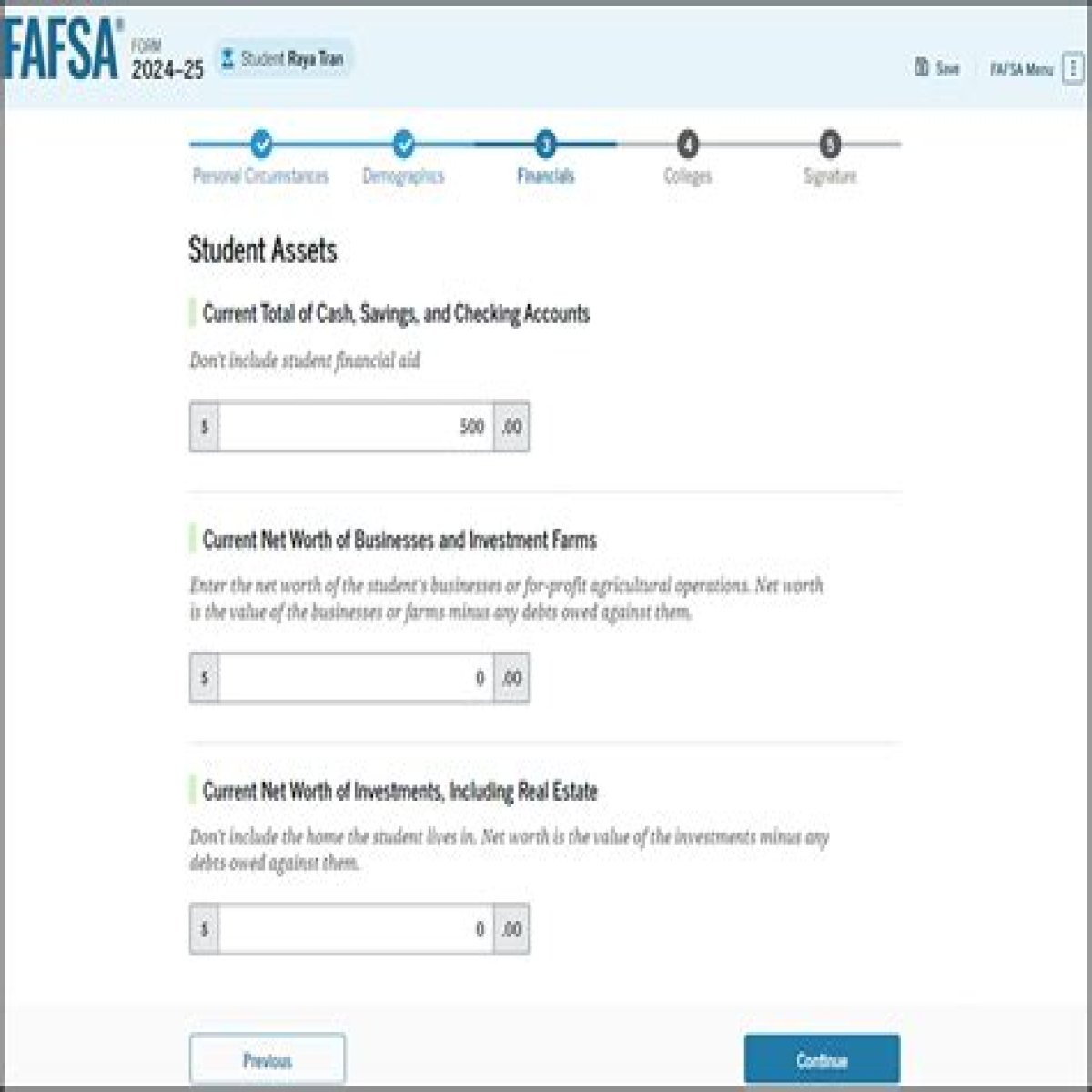

Should I skip student assets on fafsa?

Can I Skip FAFSA Questions about Assets? You can only skip FAFSA questions about assets if you meet the qualifications to do so based on your answers to other questions on the application. However, that’s only because your asset information at that point doesn’t affect your eligibility for federal student aid.

What assets are counted for financial aid?

Assets include other investments, such as real estate (other than the home in which your parents live), Uniform Gifts to Minors Act (UGMA) and Uniform Transfers to Minors Act (UTMA) accounts for which your parents are the owner, stocks, bonds, certificates of deposit, etc.

Who gets the most financial aid?

The 50 colleges that offer the most student aid

| Rank | College | Students receiving need-based aid |

|---|---|---|

| 1 | Columbia University | 2,973 |

| 2 | Yale University | 2,732 |

| 3 | Williams College | 1,014 |

| 4 | Amherst College | 1,066 |

What is the maximum Pell grant per semester?

$3173

How much does fafsa give you per semester?

If you qualify for a Federal Pell Grant, your total award for the year will be split between semesters during each school year. For example, if you’re eligible for $3,000, you will receive $1,500 for fall semester an $1,500 for spring semester.

What is a good amount of financial aid?

The average aid package is $29,916 for a school where tuition and room and board totals $40,580. The average need-based grant is $28,448. Of the total undergraduate aid awarded, the breakdown of Wofford’s scholarships/grants versus loans/work study is 86 percent to 14 percent, which is great.

Will fafsa cover my entire tuition?

Federal student aid programs generally cover 40–50% of tuition. Many GIA on-campus students borrow additional funds through either the Parent Loan Program (PLUS) if they are dependents, or through private alternative loans if they are not dependents.